Fillable Online Explanation of Missing Foreign Tax Identifying Number UNFCU Fax Email Print

a tax assessment such as an income tax return you receive from us; Do you not see the citizen service number in your proof of identity? You can find your citizen service number also in: Mijn Overheid (Dutch). You first have to login using your DigiD (Dutch). You can ask for your citizen service number at the Municipality in which you are.

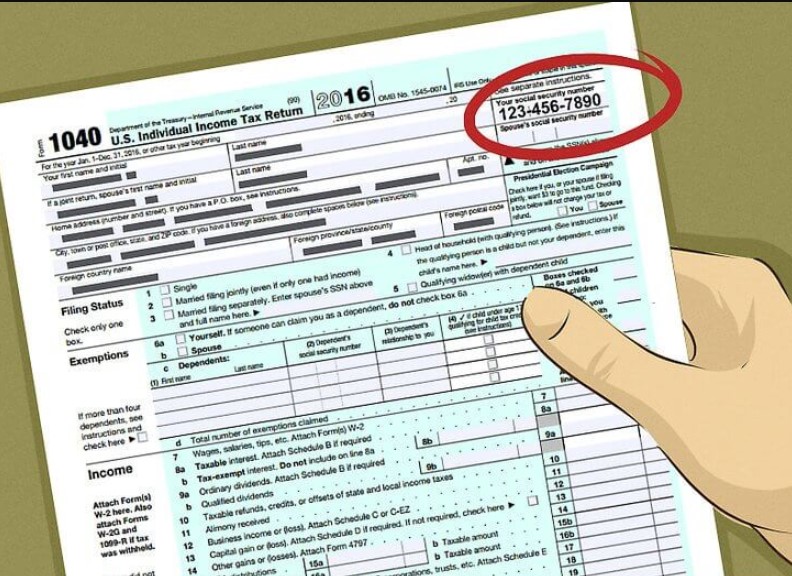

TIN Number Taxpayer Identification Number

The Citizen Service Number (BSN) | Identification documents | Government.nl You can also contact the Client Service of the Dutch Tax and Customs Administration by phonenumber +31.55.538.53.85 (Open: Monday - Thursday 08:00-20:00 - Friday 08:00-17:00) Address: Dutch Tax and Customs Administration/Limburg/ Foreign Office Kloosterweg 22

The UAE’s Tax Identification Number System

Foreign tax identifying number netherlands. If you are a foreigner living or doing business in the Netherlands, you may need to obtain a tax identification number, also known as a "BSN" or "burgerservicenummer". This number is used for various purposes, including filing tax returns and accessing government services..

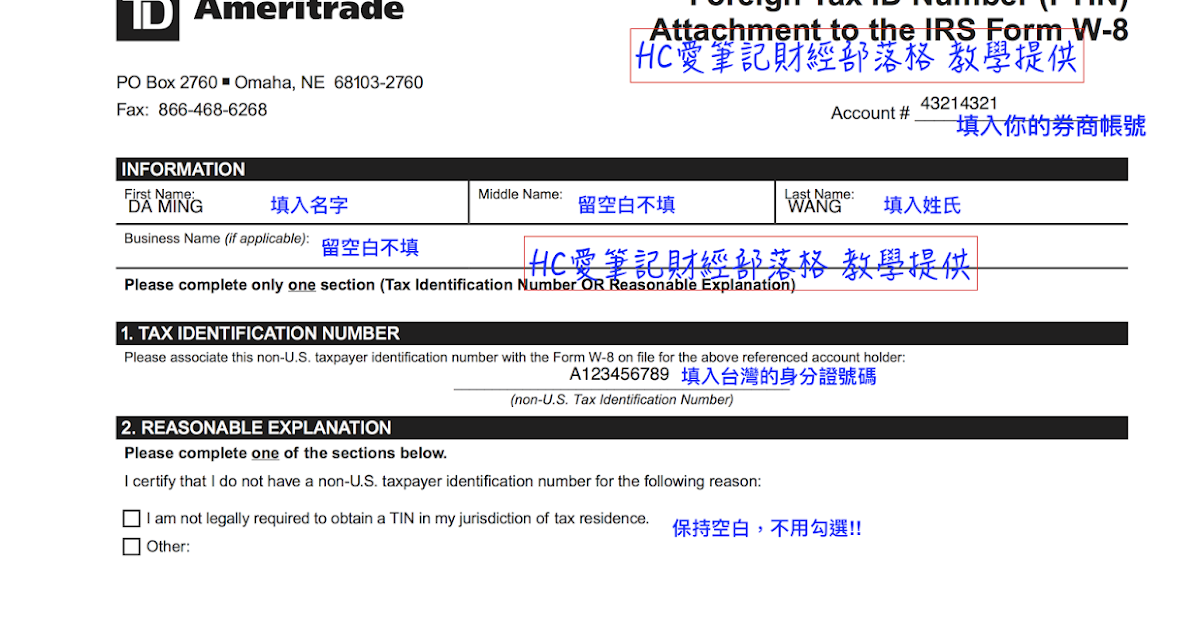

如何更新外國人稅藉編號 Foreign Tax ID Number (FTIN) 表格填寫教學 (20170915 更新) HC愛筆記財經

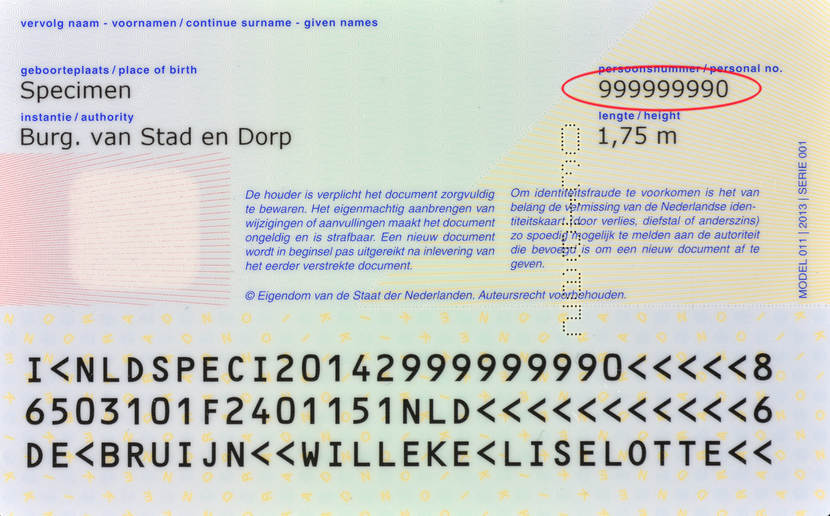

BSN Format The Dutch Tax Identification Number (TIN) consists of 9 digits, for example, 999999999. It adheres to specific validation rules and a check digit verification process outlined as follows: The TIN always comprises 9 digits: N1, N2, N3, N4, N5, N6, N7, N8, N9, where N9 serves as the check digit.

¿Dónde encuentro mi número de identificación personal en una tarjeta de identidad neerlandesa

Foreign Tax Identification. When claiming double taxation relief, you'll often need to provide your foreign tax identification number. This aids the Dutch tax authorities in verifying your tax position in the other country. Keep Abreast of Changes. Tax treaties can, at times, be renegotiated or updated.

The Netherlands, A Tax Haven Infographic Facts

Then you will be involved with the Dutch VAT regulations. In the Netherlands we also refer to VAT as turnover tax. New VAT identification number for private individual businesses. All private individual businesses have been given a new VAT identification number in order to better protect the privacy of entrepreneurs. We advise EU businesses to.

Where can I find my citizen service number on my Dutch identity card? NetherlandsWorldwide

If so, you must use the Application for VAT identification number for foreign entrepreneurs form. Different rules apply if your company is established in the Netherlands,. The Dutch Tax and Customs Administration offers extensive information in English about VAT with respect to the intra-Community supply of goods and services, import, export.

Tax Brackets in the Netherlands

The citizen service number - in Dutch written as Burgerservicenummer or BSN - is a unique personal ID number of every citizen who is registered in the population register (Municipal Personal Records Database) at the municipal authorities. The citizen service number is the successor to the 'SoFi' number. The citizen service number will.

️ Cara Mendapatkan Tax Identification Number

Tax identification numbers. This section provides an overview of domestic rules in the jurisdictions listed below governing the issuance, structure, use and validity of Tax Identification Numbers ("TIN") or their functional equivalents. The jurisdiction-specific information the TINs is split into a section for individuals and a section for.

¿Qué es el Foreign Tax Identification Number?

The Dutch identity card contains the BSN in a QR code and as readable numbers on the back of the card. These changes were implemented as part of measures to prevent identity fraud. The number consists of 9 digits. If you have an identity document but your BSN is not listed on it, you can request your BSN from the municipality.

New to the Netherlands XPAT.NL

RSIN. LEI. When you register with the Netherlands Chamber of Commerce (KVK), you are given a KVK number and (unless you register as a sole proprietor) an RSIN number. Within 10 workdays after this registration, the Netherlands Tax Administration will provide you with a BTW number for VAT purposes. You do not need to apply for this.

How to fill up tax form in deposit photo. What is foreign tax identification number?? YouTube

The current VAT identification number of Dutch private individual businesses is valid until December 31, 2019. The new VAT identification number is valid from January 1, 2020. We advise EU businesses to obtain the new VAT identification number of their Dutch private individual business clients by 1 January 2020 at the latest.

¿Qué es el Foreign Tax Identification Number? ᐈ GUÍA COMPLETA【2024

You can find your citizen service number on the following documents, among others: your Dutch passport. your Dutch driver's license. your Dutch identity card. the declaration letter that you receive from the tax authorities. a tax assessment (for example, income tax) that you receive from the tax authorities.

How To Determine Your FTIN (Foreign Tax Identification Number)? Traxsource Artist & Label Support

VAT identification number and VAT tax number. All Dutch private individual businesses have a VAT identification number (btw-id) and a VAT tax number (omzetbelastingnummer). The VAT ID is composed like this: country code NL, 9 digits, the letter 'B' and 2 check digits. The 9 digits are not related to your citizen service number and the 2 check.

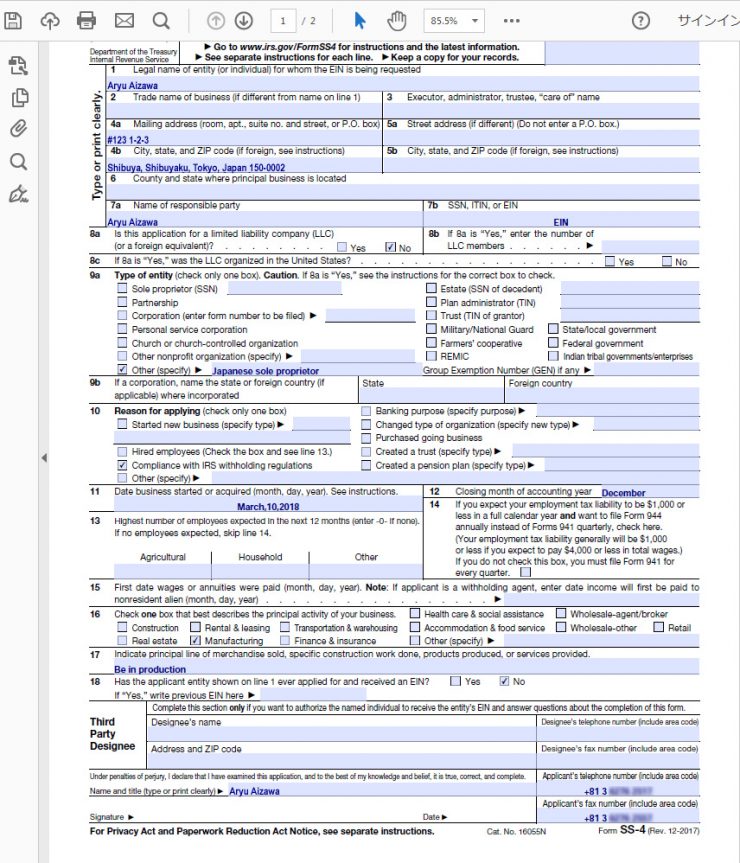

Foreign tax identifying number (EIN)を取得する|亞流

Foreign partners doing business in the Netherlands are required to obtain a tax identification number in order to fulfill their tax obligations. To obtain a TIN, foreign partners typically need to provide documentation including a valid identification, such as a passport, and proof of business registration in the Netherlands.

What Is a Tax Identification Number (TIN)?

:max_bytes(150000):strip_icc()/tax-indentification-number-tin.asp-30a92e7158164a03921914a81532f9ab.jpg)

NL - The Netherlands en - English Version 19/10/2021 16:07:00 3/8 3.1.3. Passport model 2011 TIN TIN

.